The Challenge

Local property tax authorities, often tax assessors, encounter a time-consuming and labor-intensive process when attempting to verify homeowners’ property tax exemptions. Various records must be accessed and cross-checked across multiple databases and jurisdictions to verify that the taxpayer claiming a homestead exemption is in fact eligible to claim that exemption.

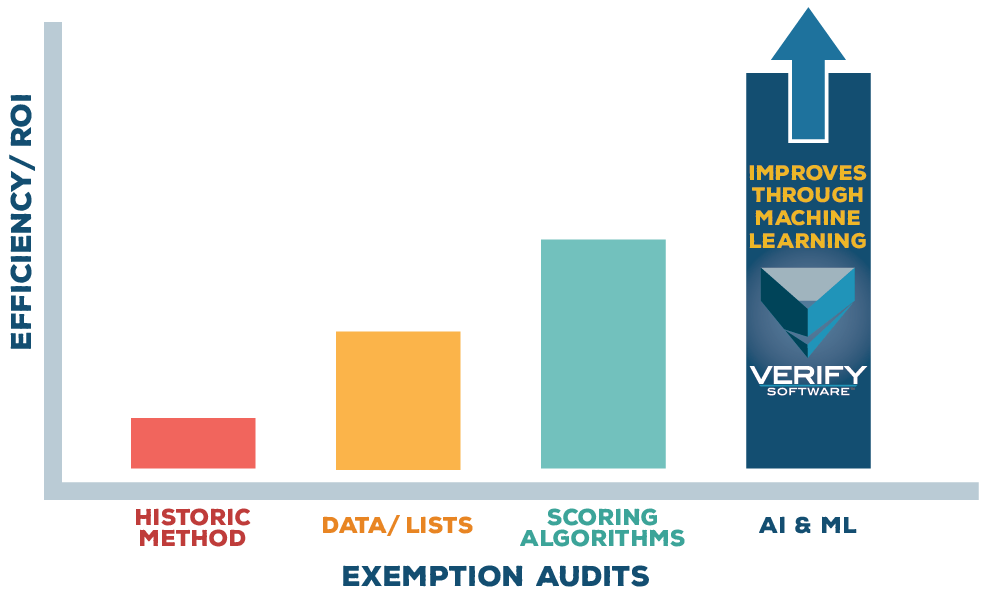

With a variety of criteria that the exemption can be claimed for, each claim required individual and manual verification. Existing automation methods only provided for a nominal increase in efficiency, leaving a huge workload on the local tax authorities to verify or deny the claims.

Assessors could only do a name-match search within their own databases to look for obvious duplicate exemptions held by the same person. Another method was to try to share a tax roll with a neighboring jurisdiction and run the same name match process. Other methods used were hand mailing letters to exemption holders and removing exemptions for properties whose mailer was returned by the post office. Finally, assessors monitor obituaries in order to identify recently deceased property owners and update their records. All of this was done by hand.

The Solution

After helping to move its core IT infrastructure over to Google Cloud Platform, Assessure Systems began consulting with Dito’s data sciences team to determine if and how this process could be automated by using Google Cloud Platform’s data analysis and learning tools.

Primarily using BigQuery, massive amounts of taxpayer data, such as Driver’s License and Voter Records, are ingested and analyzed within their secure cloud environment. Maintaining compliance with State and Federal laws which prohibit the unauthorized sharing of non-public data, the records are encrypted at-rest and in-motion while using Google Cloud Identity and Access Management tools to ensure that the data is only accessible by authorized individuals.

From the existing verified data, Dito was able to create a prediction model, built with Machine Learning APIs and Tensorflow, in order to further automate and improve the process as new data points are added to system.

Dito has also assisted in building tools to analyze smaller reports in real time, and allowing easy access to the computational power of GCP through Google App Engine.

The Benefits

Through the sophisticated use of data analytics, leveraging Big Query, App Engine, and Tensorflow on the Google Cloud Platform, Assessure Systems has built a significantly more efficient process to analyze property tax audits.

Now, an entire tax roll can be efficiently audited using Assessure’s proprietary Verify™ system and approximately 90% of all exemption violations are identified in the first 20% of the tax roll using the technology. For example, a tax roll of 100k exemptions used to require human examination of about 60k records to identify most violations. Now, just 20k records would need examination by human auditors in order to identify almost all exemption violations in the tax roll.

In St. Tammany Parish, one of the first to partner with Assessure Systems to utilize this patent-pending software “Verify™,” it is projected to result in an additional $2-3 million in tax revenue annually.

Assessure Systems is now able to help local tax authorities more efficiently verify homestead exemptions being claimed with a smaller staff in less time, which increases the ROI for the jurisdiction.

Assessure Systems has built a more efficient process to analyze property tax audits through data analytics, leveraging Big Query, App Engine, and Tensorflow. Dito also creates custom chatbot solutions to further enhance government’s interactions with their userbase.